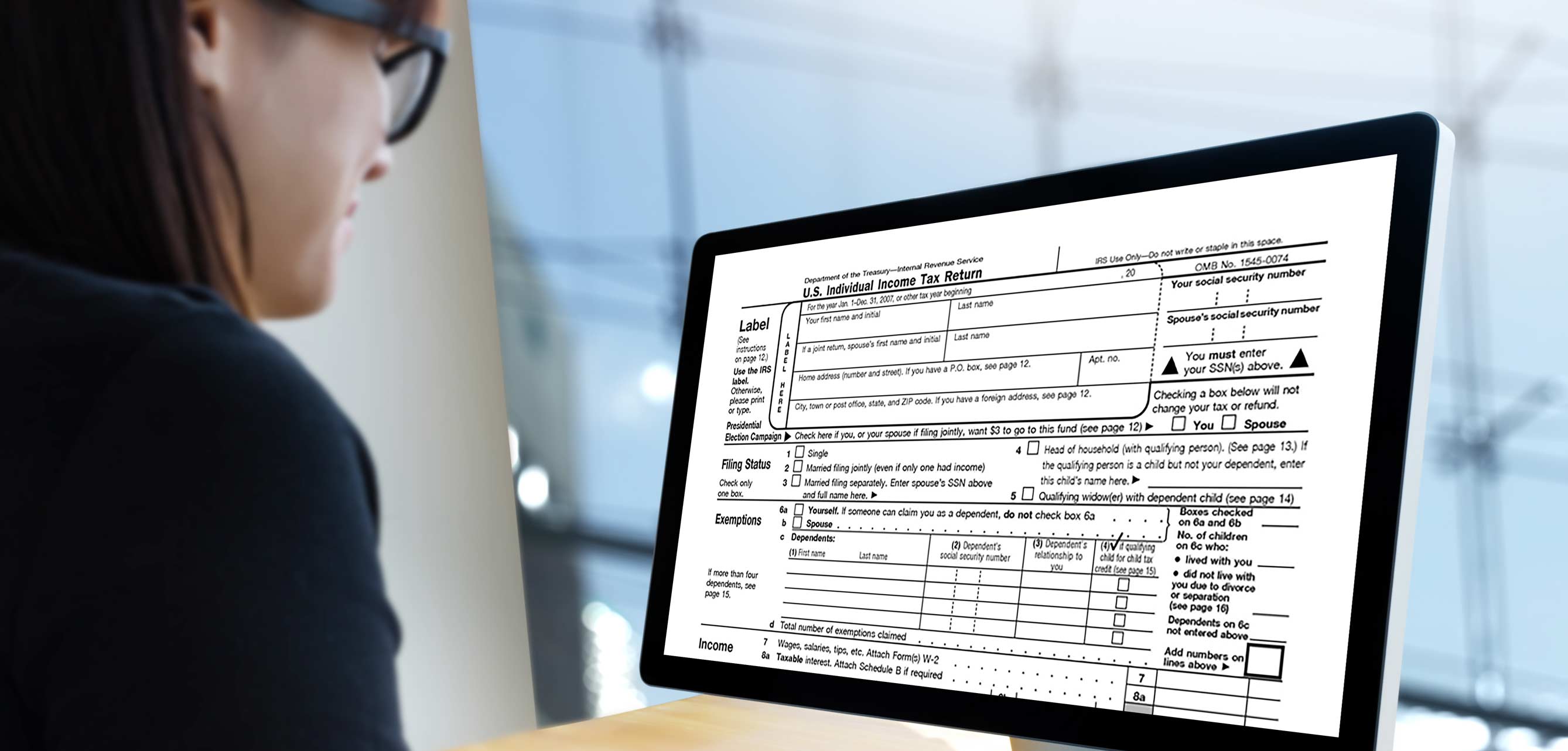

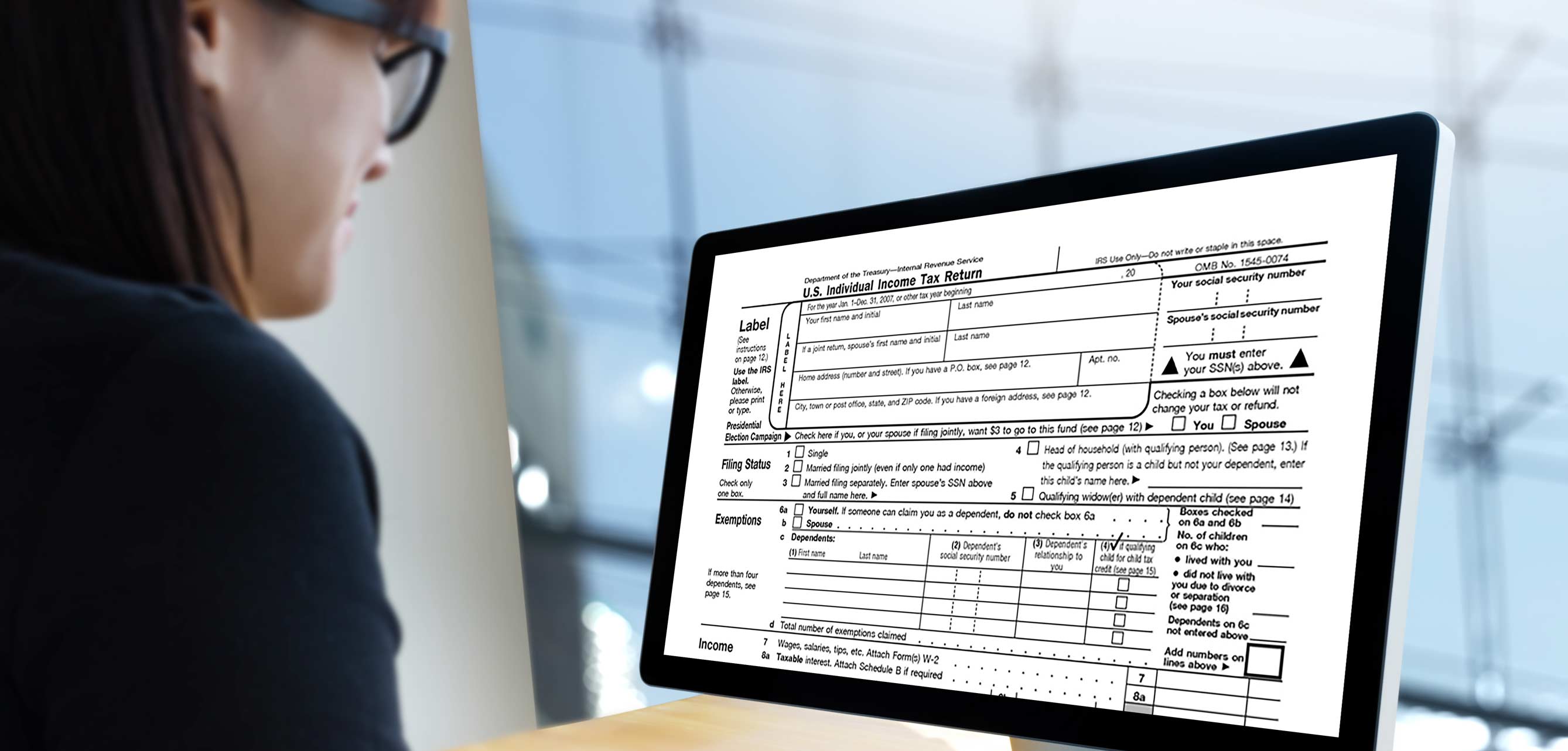

Superior offers FREE Tax Preparation and E-Filing to its members with low to moderate income. Our tax prep sites open the first week of February and will remain open for 6-8 weeks depending on the needs of the taxpayers in our communities, as well as the availability of the preparers.

All tax preparation assistance is provided by IRS-certified Superior Credit Union employees and is done by appointment only; NO walk-ins. This program is done in a drop-off and pick-up fashion. Every member that would like to have their taxes filed with Superior must complete the online prescreening process.

If we are full in your region, please visit https://freetaxassistance.for.irs.gov/s/sitelocator to search for other free tax preparers in Ohio by zip code.

To see if you qualify for this service, please answer the questions below. If you do qualify, Superior will call you to schedule an appointment within five business days.

Since visiting Superior Credit Union both Laurie and I have become members and moved money into investments through Superior. We have been VERY happy with the service provided by Tim Niebel and others that we have come in contact with. The customer service and value of being appreciated as a member by far surpasses any bank we have been in contact with or used. Prior to playing the Piggy Bank promotion, I had barely heard of Superior and after we talked to many of our friends who are members and got excellent reviews.Bill & Laurie

Love the people working at my branch. They helped me not only set up a checking and savings account but also a 12 month CD. Thank you guys for the help.Noel N.

John was very very helpful, gave me insight on savings accounts and helped me get what I needed quickly!Dylan W.

Melissa was amazing! She made the home buying process go smoothly and if we needed anything, she was right on top of it. She was very nice and always willing to explain something to us! Would use her as a loan originator again!Kyrra & Morgan

Buying a house is an overall stressful situation. You feel like you’re waiting for something to go wrong. Melissa pretty much took us under her wing and made sure everything was smooth going and taken care of! I not only got to buy our home, but I made a new best friend! Melissa not only knows what she is doing but she makes you feel like you know what you’re doing! She’s phenomenal at what she does!Chuck & Brittany

We purchased a home and received $2,000 towards our closing through SuperiorFirst. We went through Katie at the Elida branch, and she was a big help in getting that and answering all the questions we had along the way. As first-time homebuyers, Superior was a big help throughout the process!

As first-time homebuyers, Superior made it easy. We applied for or home loan online and heard back with our pre-approval within a couple of days! Alisha Reaman was super helpful and informative. She answered all of our questions and explained all the steps during our home buying process. We are extremely thankful for Alisha and the rest of the Superior staff, even more thankful for being chosen to receive the first-time homebuyers grant through Superior! We highly recommend Superior for first-time homebuyers!Ian & Savanna

Without the SuperiorFirst grant funds and help of Superior Credit Union, homeownership would not have been possible. The process from pre-approval to closing was very easy.Kalen L.

Todd and the rest of the amazing Superior staff made my vehicle purchase smooth and convenient for me. They truly went above and beyond to provide the most fantastic customer service, well past their closing hours so I could pick up my vehicle on time. I cannot thank them enough, from our personal accounts, business account, mortgage and now two auto loans - Superior is our number one choice!Holly S.

Thanks for your help with the loan!!! Love love love this car!!!Amanda M.

With the recent reduction in interest rates, we inquired to see if we could qualify for a better mortgage rate with Superior. We applied online to inquire about refinancing and were contacted within a day by Alisha at Superior. She provided us with plenty of information, answered all our questions and was great to work with. We qualified for a better interest rate which ultimately led to a reduction on our minimum principal and interest payment. This gave us the ability to reduce the time to pay off our mortgage by making the same monthly payment as we were with our previous lender. Superior was easy to work with, willing to answer all our questions and, most important, helped us save money.Alyssa & Chris

Dawn M.GOLD! GOLD! GOLD! SUPERIOR WINS GOLD ! What an absolute pleasure and experience opening accounts with Justin! Every I dotted and t crossed and I'm on my way to a new banking relationship after 45 years after moving to the area and my TWO financial mainstays do not have a presence within 50 miles and in another state. JUSTIN MADE IT SEAMLESS AND EFFICIENTLY ANSWERED EVERY QUESTION, CALMED EVERY CONCERN . Thank you so very much! SUPERIOR!

I received calls from someone claiming to be from PayPal. So I called the Credit Union, and as a result, they put me in touch with someone in fraud, and I talked to Jessica! Jessica makes me feel like she is the person I should call! I felt really safe. Thank God for Superior. You’re [Jessica] like a guardian angel!Mary Franklin

Julie and Kelly were both fantastic, they met all our needs and very professional. Even when we hit small roadblocks they worked through it, and always found solutions. Great company to work with, they will help save you tons of money.Shawn & Natalie

Love using Superior Insurance Services. They always work with me on bills and claims to see if I should claim something or if there are better options to lower my bill. Keep up the great work.Bruce H.

Very friendly and helpful staff. They go the extra mile and I saved a lot on my auto and apartment renter's insurance. It made a big change to my budget! Thank you Wendy!Elizabeth M.

Dawn M.GOLD! GOLD! GOLD! SUPERIOR WINS GOLD ! What an absolute pleasure and experience opening accounts with Justin! Every I dotted and t crossed and I'm on my way to a new banking relationship after 45 years after moving to the area and my TWO financial mainstays do not have a presence within 50 miles and in another state. JUSTIN MADE IT SEAMLESS AND EFFICIENTLY ANSWERED EVERY QUESTION, CALMED EVERY CONCERN . Thank you so very much! SUPERIOR!

Melissa was amazing! She made the home buying process go smoothly and if we needed anything, she was right on top of it. She was very nice and always willing to explain something to us! Would use her as a loan originator again!Kyrra & Morgan

Buying a house is an overall stressful situation. You feel like you’re waiting for something to go wrong. Melissa pretty much took us under her wing and made sure everything was smooth going and taken care of! I not only got to buy our home, but I made a new best friend! Melissa not only knows what she is doing but she makes you feel like you know what you’re doing! She’s phenomenal at what she does!Chuck & Brittany

I received calls from someone claiming to be from PayPal. So I called the Credit Union, and as a result, they put me in touch with someone in fraud, and I talked to Jessica! Jessica makes me feel like she is the person I should call! I felt really safe. Thank God for Superior. You’re [Jessica] like a guardian angel!Mary Franklin

We purchased a home and received $2,000 towards our closing through SuperiorFirst. We went through Katie at the Elida branch, and she was a big help in getting that and answering all the questions we had along the way. As first-time homebuyers, Superior was a big help throughout the process!

As first-time homebuyers, Superior made it easy. We applied for or home loan online and heard back with our pre-approval within a couple of days! Alisha Reaman was super helpful and informative. She answered all of our questions and explained all the steps during our home buying process. We are extremely thankful for Alisha and the rest of the Superior staff, even more thankful for being chosen to receive the first-time homebuyers grant through Superior! We highly recommend Superior for first-time homebuyers!Ian & Savanna

Without the SuperiorFirst grant funds and help of Superior Credit Union, homeownership would not have been possible. The process from pre-approval to closing was very easy.Kalen L.

Todd and the rest of the amazing Superior staff made my vehicle purchase smooth and convenient for me. They truly went above and beyond to provide the most fantastic customer service, well past their closing hours so I could pick up my vehicle on time. I cannot thank them enough, from our personal accounts, business account, mortgage and now two auto loans - Superior is our number one choice!Holly S.

Superior has all-new Online Banking! Get started today: